It is not a secret that Lithium has become a crucial component for electrochemical energy storage devices, commonly known as batteries. Lithium-ion (Li-ion) batteries are the unquestionable rulers of energy storage devices in portable electronics and the emerging sectors of electric mobility and grid storage. Despite the rapid expansion of Li-ion battery production worldwide and parallel expansion of lithium mining, there are a number of questions posed for the mid and long-term prospects of this industry. While, in the mid-term there are potential technological drivers, capable to raise competition to the Li-ion technology, on the longer term there are also questions of supply capabilities. It is evident that Li-ion is due to retain its role as the dominant technology for energy storage in the coming years, but a critical outlook on global Lithium resources is important in order to prepare for potential disruptions in this market. This survey is bringing you the updated analysis of raw Lithium production worldwide, providing rough estimates for the mid and long-term production trends.

Lithium is first of all a metal, which can be found in the form of Lithium salts in various locations across the globe and when in large concentrations – such locations are identified as Lithium resources. Currently, Lithium resources are utilized by a number of end-use industries, including manufacturers of batteries, ceramics & glass, greases, air treatment devices, casting mold powders, polymers and more. The most dominant utilization of Lithium has recently become electrochemical Li-ion cells and with current rapid expansion of battery production, it is assumed that batteries would be overwhelmingly dominant target markets for Lithium resources for at least a couple of decades.

Though there are several variants of the Li-ion technology on the market, the most dominant one is based on Lithium Cobalt Oxide (LCO) cathode electrodes with Lithium salts as electrolyte and carbon as an anode, which altogether require a considerable amount of Lithium metal per cell. Other Li-ion technologies are not principally different in this sense, with some variance of Lithium-containing cathodes and electrolytes coupled with a number of anode types achieving slightly differing power and specific density figures. As such, the growth of the Li-ion industry would require a parallel expansion of mining and processing enterprises – mainly targeted on producing high-grade Lithium carbonate and to a lesser degree on Lithium chlorate and Lithium hydroxide.

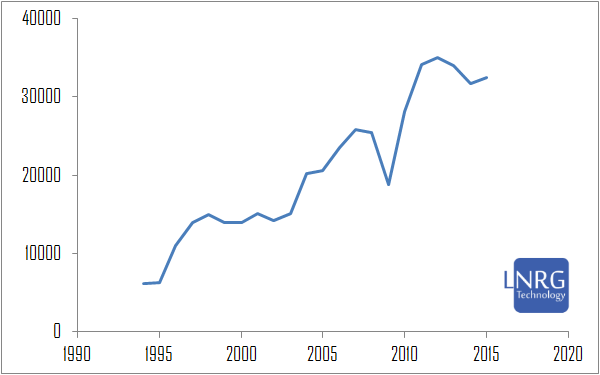

According to the US Geological Survey (USGS), the global production of Lithium, excluding US, reached 32,500 metric tons in 2015. This should be added with the unreported US production, which is likely somewhere around 870 metric tons annually. The global demand for Lithium in 2015 is estimated at 32,500 metric tons, presenting a 5% annual growth from 2014 – mostly due to rapid expansion of Li-ion battery production enterprises. With the developing hunger of the battery producing enterprises, Lithium production and processing industries are due to an inevitable expansion. The question is however for how long this expansion is to go on before reaching its peak, as Lithium resources in Earth's crust are limited. The latest USGS estimate for available Lithium reserves and resources is 14.0 million and 40.7 million metric tons respectively. Theoretically, with current production rates, the resources would be sufficient for more than a thousand years. This is however an over-simplification, disregarding the rapid production growth and market constraints.

Figure 1. Lithium production worldwide 1995-2015 (except US) in metric tons, according to USGS data.

Is this possible to have a more realistic estimate for future rates of Lithium production? The answer is yes and this can be achieved by a combination of predictive analysis and a fundamental assessment of resources. First of all, the known reserves and resources of Lithium are periodically supplemented with new discoveries. During the past two decades known Lithium resources have increased by more than three-fold and there is a reason to believe this is not the end of Lithium discoveries. However, Lithium is still uncommon and thus there is a slim chance for further three-fold growth from current estimates, unless Lithium prices skyrocket or new technologies for Lithium production from low-concentrated brines are invented. Using a strictly mathematical predictive analysis on actual Lithium production data set 1995-2015, but disregarding the total volume of resources, the peak production is to be expected in 2029. On the other hand, assuming that all known Lithium resources are to be mined and processed, the peak production is to be expected only in the second half of the 21st century.

The extended commercial report can be purchased at LNRG Technology digital store (below).