Over the past year, the Israeli electricity market continued to undergo increasing privatization of the electricity generation segment, with growing domination of natural gas as primary energy resource and rapidly increasing, though still minor, role of private renewable energy. By the end of 2016, Israeli national electric generation capacity was at 17.6 GWp, with IEC making up 77.0% of total grid connected production capacity, while private producers made up the remaining 23.0%. While as of 2017 the electricity sector in Israel is undergoing a period of transformation, the Israeli electricity production segment is still dominated by the IEC though its share is steadily declining. The rise of electricity demand per capita seems to have become arrested in recent years and though there is still a certain growth due to demographic expansion, the main drive for introduction of new private generation facilities is mostly reduction of coal-fueled electricity generation by the IEC.

Over the past year, the Israeli electricity market continued to undergo increasing privatization of the electricity generation segment, with growing domination of natural gas as primary energy source and rapidly increasing, though still minor, role of renewable energy. The IEC has been denied from building new conventional power plants for many years, but in the private sector new permanent licenses were granted to Israeli Airport Authority 12.4 MWp power plant near Lod and four more privately held conventional power plants are to be inaugurated by the end of 2017. In regard to renewable energy, much new capacity was installed by private solar energy sector with PV segment dominating with addition of over 150 MWp, but without new installations in the solar thermal segment; hence solar PV segment had reached nearly 800 MWp grid-connected capacity by the end of the year in line with zero megawatts in solar thermal, where first large-scale installation is only expected to come online in 2017. Wind energy sector expanded with three wind farms inaugurated in Northern Israel over the past year with combined capacity of 21 MWp. Other renewable sectors, including hydropower and biogas remained stable.

By the end of 2016, Israeli national electric generation capacity was at 17.6 GWp, with IEC making up 77.0% of total grid connected production capacity, while private producers made up the remaining 23.0%. While as of 2017 the electricity sector in Israel is undergoing a period of transformation, the Israeli electricity production segment is still dominated by the IEC though its share is steadily declining. Thus by the end of 2017, the installed capacity of private electricity generation facilities is to reach 26% and nearly 60% by early 2020s.

Figure 1. Installed electricity generation capacity in Israel in December 2016: IEC (blue) and Private Producers including renewables (red).

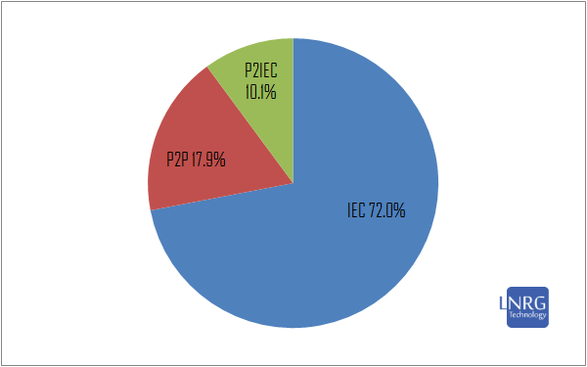

In terms of actual generation, about 66.7 million kWh were produced in 2016, as IEC produced 72.0% and added with electricity purchased from private producers it altogether controlled 82.1% of total generation, whereas the remaining 17.9% consisted of output supplied by private producers directly to customers or electricity self-consumed by small PV producers. In terms of actual electricity generation, private production share hence reached record 28.0% of annual grid output through the year.

Figure 2. Actual generation of electricity in Israel for 2016: IEC (blue), Private producers who sell to private consumers (red) and Private producers who sell electricity to IEC (green).

The generation segment was relying on a mix of fuels, dominated by natural gas and coal - both utilized by the IEC as primary fuels. Secondary fuels of the IEC were diesel, oil fuel and methanol. Private generation facilities were primary relying on natural gas, while diesel, oil fuel, kerogen and renewables were secondary energy sources.

Figure 3. Capacity of the electricity generation segment in Israel by primary fuel type, correct for December 2016. Notes: diesel is calculated combined with methanol; natural gas is including both CNG and LNG.

The total production of electricity per capita remained unchanged from 2015 and was slightly above 7.7 thousand kWh annually, whereas the demand per capita was about 5.9 thousand kWh annually. The rise of electricity demand per capita seems to have become arrested in recent years and though there is still a certain growth due to demographic expansion, the main drive for introduction of new private generation facilities is mostly reduction of coal-fueled electricity generation by the IEC.

The transmission, the distribution and the grid control are almost entirely courtesy of the IEC and this is not about to change in foreseeable future, unless a major disruption is encountered. The off-grid electricity market in Israel is essentially small, estimated at several megawatts deployed in desolate locations, including diesel generators and solar PV collectors.

The premium member data page access and extended commercial report can be purchased at LNRG Technology digital store.