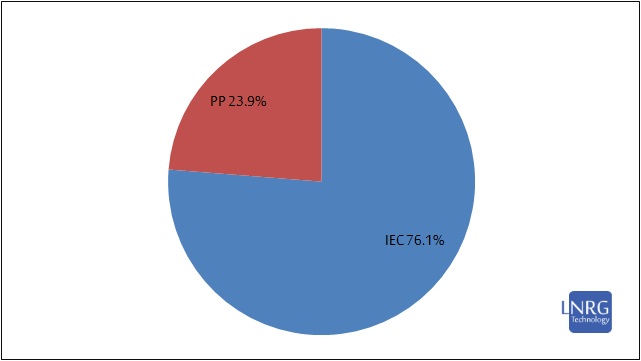

This report encloses developments and statistics of the Israeli electricity market as of 2018, with emphasis on the generation segment. During the past year, the Israeli electricity market continued a crawling privatization process of the electricity generation segment in parallel to negotiations on a profound Electricity Market reform, which is also aimed to address the distribution and grid control segments. By the end of 2017, Israeli national electric generation capacity was at 17.8 GWp, with IEC making up 76.1% of total grid-connected capacity, while private producers made up the remaining 23.9%. In terms of electricity generation, 67.9 million kWh were produced in 2017 in the Israeli market. In 2017, the generation segment was relying on a mix of fuels, dominated by natural gas and coal - both utilized by the IEC as primary fuels. Secondary fuels of the IEC were diesel, oil fuel and methanol. Private generation facilities were primary relying on natural gas, while diesel, oil fuel, kerogen and renewables were secondary energy sources.

During the past year, the Israeli electricity market continued a crawling privatization process of the electricity generation segment in parallel to negotiations on a profound Electricity Market reform, which is also aimed to address the distribution and grid control segments. By the end of 2017, Israeli national electric generation capacity was at 17.8 GWp, with IEC making up 76.1% of total grid-connected capacity, while private producers made up the remaining 23.9%. By the end of 2018, the installed capacity of private electricity generation facilities is expected to surpass 30.0% share (22.6% excluding renewables) and as much as 60.0% by the early 2020s.

Figure 1. Installed electricity generation capacity in Israel as of December 2017 by producer: IEC (blue) and Private Producers including renewables (red).

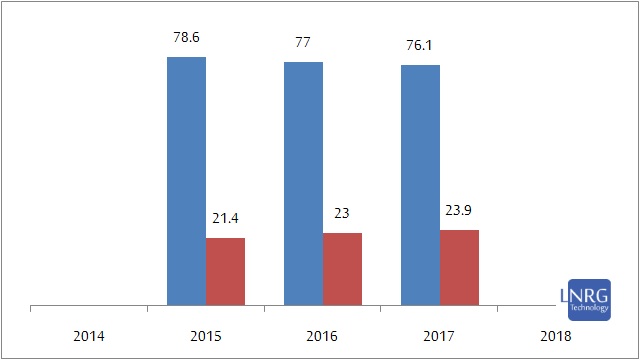

For the past decade, the IEC has been denied from building new conventional power plants, thus practically all conventional additions have been made by the private sector. In terms of conventional generation, the 140 MWp Soreq gas-powered plant was connected to the grid on September 2017, though had began synchronization in late 2016; four more privately held conventional power plants were supposed to be inaugurated in 2017, however all delayed. The IEC capacity remained unchanged during 2017, with later retirement of two generation units with 282 MWp capacity in early 2018. The pump accumulation power plant in Gilboa neared to inauguration, with expected completion of synchronization in 2018. In regard to renewable energy, much new capacity was installed in the solar energy sector with PV segment domination, which added 104 MWp on the course of 2017; in addition, the solar thermal segment neared inauguration with the beginning of test-runs of two Ashalim power plants with combined capacity of 250 MWp, expected to be synchronized in 2018. Solar electricity generation segment hence reached nearly 1,000 MWp of grid-connected capacity by the end of 2017, with a more aggressive expansion expected in 2018. Wind energy sector remained stable through 2017, with a total of four existing wind farms in Northern Israel. Other renewables, including hydropower and biogas remained stable as well, with a single biogas plant expected to go online in 2018.

Figure 2. Installed electricity generation capacity evolution in Israel (percent of total) as of December each year 2015-17 by producer: IEC (blue) and Private Producers including renewables (red).

In terms of electricity generation and supply, 67.9 million kWh were produced in 2017 in the Israeli market. IEC produced 71.4% and added with electricity purchased from private producers, the IEC altogether controlled 82.4% of total electricity supply, whereas the remaining 17.6% consisted of output supplied by private producers directly to customers or schemes of self-consumption (mostly by small PV producers). Private production share hence reached 28.6% during 2017 and is expected to continue rising through 2018 to surpass 30.0%. This implies a significant overshoot of governmental original target of 20% private electricity production by 2020.

Figure 3. Supply of electricity in Israel during 2017: IEC (blue), Private producers who directly sell to private consumers (red) and Private Producers who sell electricity to IEC for later distribution (green).

In 2017, the generation segment was relying on a mix of fuels, dominated by natural gas and coal - both utilized by the IEC as primary fuels. Secondary fuels of the IEC were diesel, oil fuel and methanol. Private generation facilities were primary relying on natural gas, while diesel, oil fuel, kerogen and renewables were secondary energy sources. When combined, the electricity generation segment continued to be dominated by natural gas as the primary energy source (65.8% by capacity), with coal as the secondary source (27.1% by capacity) and third place taken by renewables (5.8% by capacity) – predominantly solar PV technology (5.5% by capacity). In terms of electricity production, natural gas composed of 63%, coal 33%% and other fossil fuels at 1% of total. Electricity production from renewable sources reached the level of 3% of total.

Figure 4. Capacity of the electricity generation segment in Israel by primary fuel type as of December 2017. Notes: diesel is calculated combined with methanol; natural gas is including both CNG and LNG.

The production of electricity per capita was about 7.8 thousand kWh annually, the grid supply per capita was 6.5 thousand kWh annually, whereas the electricity demand per capita was about 6.0 thousand kWh annually. The total demand grew by 1.2% from 2016 to 2017, even though the demand per capita remained stable. The Electricity Authority project that the growth in electricity demand in upcoming years is to be at 2.7% annually, which is slightly above the demographic growth rate. However, the rise of electricity demand per capita in Israel seems to have become largely arrested in recent years and though there is still a certain total demand growth due to demographic expansion, the main drive for introduction of new private generation facilities is mostly reduction of coal-fueled electricity generation by the IEC.

The transmission, the distribution and the grid control are almost entirely courtesy of the IEC, though this situation is about to change with the adoption of Electricity Reform, which is due to split grid control department into a separate company and reduce the IEC share in electricity distribution. In regard to the distribution segment, the electricity pricing for domestic consumers remained unchanged during 2017, though on average was 3.7% higher than in the previous year due to the price increase in December 2016. The off-grid electricity market in Israel is essentially small, estimated at only several megawatts deployed in desolate locations, including diesel generators and solar PV collectors.

The premium member data page access and extended commercial report can be purchased at LNRG Technology digital store.