The year 2020 would be remembered as a very volatile period in the oil market, which fluctuated from a positive bullish trend to an historic collapse into negative prices by late April and then some stabilization for the rest of the year. In 2020, oil traded at an average pricing of 41.76 USD per Brent oil barrel and vast range of 18.38-63.65 USD on monthly basis. This study aims to provide a projection for next year's average oil pricing, utilizing predictive analysis methods correlated with fundamental analysis. Evidently, predictive analysis cannot provide accurate answers, since it is rather providing a statistical probability, but we can define a high probability range with fair accuracy.

The conventional crude oil sector is an enormous market, with a daily turnover of over 3 billion US Dollars, not including investments and indirect expenses and excluding non-conventional resources. Annual crude oil sales revenue was around 1.2 trillion US Dollars throughout 2020, which is nearly 1.4% of global GDP; all primary liquid fuels sales are estimated at about 1.6 trillion US Dollars. Despite decreasing importance of conventional crude oil, it is still making up a lion share of the global energy market. Conventional crude oil supply was at the level of 78 million bpd, which is about 81% out of total 96 million bpd of primary liquid fuels, whereas liquid fuels compose some 30% of the primary energy market. Thus, conventional crude oil has significantly dropped from its peak primary energy market share of 50% in the 1970s, but is still critical for global economy. Conventional crude oil is primarily important for the transportation sector, though there is a wide use of oil products for backup power, industrial heating and for electricity production in non-OECD countries. Conventional crude oil is also widely utilized as a source for oils and polymers in the plastics and cosmetics industries.

Passing 2020th year would be remembered as a very volatile period in the oil market, which fluctuated from a positive bullish trend to an historic collapse into negative prices by late April and then some stabilization for the rest of the year. In 2020, oil traded at an average pricing of 41.76 USD per Brent oil barrel and vast range of 18.38-63.65 USD on monthly basis. With global oil supply and demand closely corresponding, a further instability in global economy may set massive price moves in both directions. The importance of production stability is highlighted upon the growing geopolitical tensions in the Persian Gulf, while the supply side is greatly affected by the COVID19 crisis.

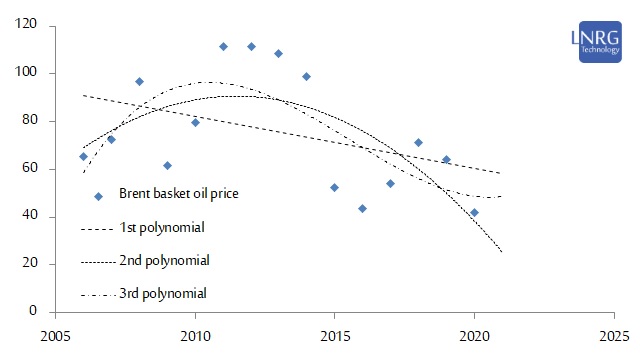

This study aims to provide a projection for average crude oil pricing during 2021, utilizing predictive analysis methods correlated with fundamental analysis. The herewith described price projection is based on the mathematical extrapolation model, which is derived from 15-year long and 10-year long Brent basket oil price trends. It is of course an assumption that polynomial trend extrapolation of first, second, third and fourth degree is sufficiently accurate to predict oil pricing in the short term of a single year. Such a model can be defined as "non-linear predictive analysis", and in case the assumption is correct - it allows us to provide reasonable projections for a limited time range. This is not a perfect method for financial predictions and is in fact rarely utilized by economists, but is much more objective compared with fundamental analysis and is certainly much more reliable than a simple "business-as-usual" scenario (zero or first degree polynomial fit), which is the dominant, but mostly imprecise, tool in many economic models.

Figure 1. Annual average Brent basket oil price during 2005-2020, with mathematical predictive analysis fits of first polynomial, second polynomial and third polynomial degrees to the 15-year price trend of oil.

In regard to the previous projection for 2020 oil based on the 15-year price trend, the most precise result was derived from the 2nd polynomial fit, which had a good correlation with the actual average annual oil price. Better results could be derived from the 10-year price trend model and the most accurate by the combination of two models, which gave the range of 50-75. The actual average pricing of 41.76 USD per Brent barrel was exceptionally affected downwards by the "Black Swan" event of the pandemic. Using the above assumptions, the same polynomial fits can be applied for average annual oil price data series, in order to produce projections for average annual oil price in 2021.

With such regrressional mathematical analysis, there is a wide selection of results, ranging from strongly positive direction per first polynomial fit to collapse per second and third polynomial fit with the 15-year price trend model. Evidently, predictive analysis cannot provide accurate answers, since it is rather providing a statistical probability, but we can define a high probability range with fair accuracy. With predictive analysis models of 10-year and 15-year pricing trends we should expect an average Brent oil pricing in the range of 40-55 USD per barrel during 2021.

Disclaimer

The above presented data is a general informative survey and is not to be considered as a consulting in any way in relevance to capital investment, securities or any other financial instrument. For the avoidance of doubt, the author of this survey is not a certified investment consultant and hence the content of this document is not inclining the readers towards any financial action. It should be emphasized that the reader is recommended to check and verify the content of the above survey prior to obtaining any conclusions of it, since misunderstanding of written material might occur and that there could be unintentional data errors and resulting errors in the analysis. The content of this survey, including every part of it, as well as charts and analyses, are protected by the 2007 Copyright Act of the State of Israel and are not to be used in any way without the explicit approval of LNRG Technology. Charts and images from external sources are utilized in the survey with appropriate licenses; any use of such external charts and images by reader is under the direct responsibility of the reader and under the explicit conditions of the relevant author.

The extended commercial report can be purchased at LNRG Technology digital store (below).