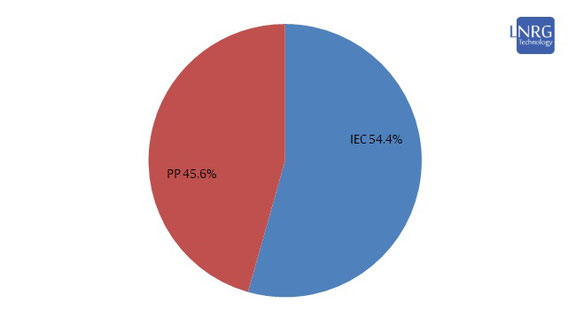

This report overviews the 2021-22 developments in the Israeli electricity market with emphasis on the power generation segment. Despite delays attributed to the pandemic lockdowns, a significant progress continued in the renewables segment with integration of hundreds of MWp in 2021 and 2022, led by the solar segment. By the end of 2021, Israeli national electric generation capacity was at 21.5 GWp, with IEC making up 54.4% of total grid-connected capacity, while private producers made up the remaining 45.6%. In terms of electricity generation and supply, 74.0 million kWh were produced in 2021 in the Israeli market, up from 72.8 million kWh in 2020. The 2021 generation segment was relying on a mix of fuels, dominated by natural gas and coal - both utilized by the Israel Electric Corp (IEC) as primary fuels. Secondary fuels of the IEC were diesel, oil fuel and methanol. Private power generation facilities were primary relying on natural gas, while diesel, oil fuel, kerogen and renewables were secondary energy sources.

Despite delays attributed to the pandemic lockdowns, a significant progress continued in the renewables segment with integration of hundreds of MWp in 2021 and 2022, led by the solar segment (924 MWp in 2021 and nearly 1 GWp expected in 2022) and also inaugurating the largest Israeli wind power 109 MWp Emek Bakha project. By the end of 2021, Israeli national electric generation capacity was at 21.5 GWp, with IEC making up 54.4% of total grid-connected capacity, while private producers made up the remaining 45.6%. The private generation sub-segment, including renewables, is hence closing to one half share of the market and is expected to reach as much as 62.0% share by 2025.

Figure 1. Installed electricity generation capacity in Israel as of December 2021 by producer: IEC (blue) vs Private Producers including renewables (red).

For the past decade and a half, the Israel Electric Corporation (IEC) has been denied from building new conventional power plants, thus practically all conventional additions have been made by the private sector. Moreover, upon the Electricity Market Reform, the IEC is being forced to sell several generation units, though enabling it to upgrade some of its units in the future. The IEC capacity further reduced upon retirement of several generation units in 2019 and privatization of two compounds in 2019 and 2020 respectively; another IEC site of Hagit completed the privatization process in December 2021, to be followed by Eshkol and then possibly Reding compound.

In terms of privately-held conventional generation, several power plants began continuous operation over the past year and a half, notably including the Beer Tuvya natural gas power plant which went online in February 2021. In regard to renewable electricity generation, much new solar capacity was installed, reaching 3 GWp at the end of 2021, the largest facility connected in 2021 was Timna site of 60 MWp. Wind energy segment remained stable through 2021, awaiting major sites of Emek Bakha and Bereshit connection and synchronization by 2022. Hydropower capacity remained stable in 2021 and is not expected to change in 2022. Finally, no small-scale biogas plants have yet been added in 2021-22. Kokhav Yarden 344 MWp pump accumulation project is due to come online by the end of 2022.

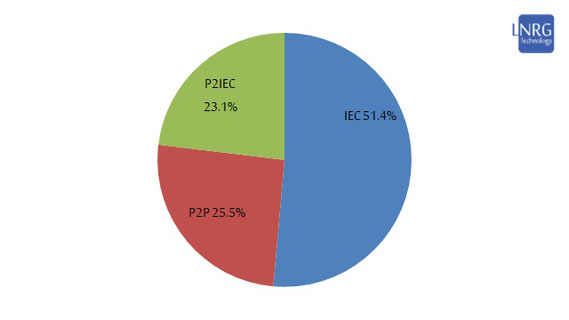

In terms of electricity market generation and supply, 72.8 million kWh were produced in 2020 and about 74.0 million kWh in 2021, with 75.0 million kWh expected to be generated in 2022. Through 2021, IEC produced 51.4% of supply and added with electricity purchased from private producers, the IEC altogether controlled 74.5% of total electricity supply, whereas the remaining 25.5% consisted of output supplied by private producers directly to customers or schemes of self-consumption (small PV producers and four conventional power plants). Private generation share hence reached 48.6% during 2021 and is expected to continue rising through 2022 to surpass 50%. This already brings closer the electricity reform target of maximum 40% IEC generation, favoring the distribution of the electricity market in favor of IPPs and renewables to surpass 60% market generation output.

Figure 2. Supply of electricity by producer in Israel during 2021: IEC (blue), Private Producers who sell directly to consumers (red) and Private Producers who sell electricity to IEC for later distribution (green).

In 2021, the generation segment was relying on a mix of fuels, dominated by natural gas and coal - both utilized by the IEC as primary fuels. Secondary fuels of the IEC were diesel, oil fuel and methanol. Private generation facilities were primary relying on natural gas, while diesel, oil fuel and renewables were lesser energy sources. When combined, the electricity generation segment continued to be dominated by natural gas as the primary energy source (58.0% by capacity), with coal as the secondary source (22.5% by capacity) and third place taken by renewables (17.0% by capacity) – predominantly solar PV technology (14.95% by capacity), as well as smaller capacities of ST, wind, biogas and hydro. Pump accumulation accounted for 1.4% of capacity, while other fossil fuels contributed a tiny fraction (0.4% of total capacity). In 2022, renewables' share is expected to experience further growth, closing to 20% of total capacity.

Figure 3. Capacity of the electricity generation segment in Israel by primary fuel type as of December 2021. Notes: diesel is calculated combined with methanol; natural gas is including both CNG and LNG.

Grid supply per capita slightly decreased from 6.4 thousand kWh in 2018 and 2019 to 6.2 thousand kWh annually in 2020, and further decreased to 5.9 thousand kWh in 2021. The electricity demand per capita also decreased from 5.9 thousand kWh annual in 2018 and 2019 to 5.7 thousand kWh in 2020 and 5.5 thousand kWh annual per capita in 2021. Total electricity generation per capita in Israel was 8.0 thousand kWh annual in 2018 and 7.9 thousand kWh annual in 2019, then decreasing to 7.9 thousand kWh annual in 2020 and 7.8 thousand kWh in 2021. The 2022 electricity generation supply and demand figures per capita are expected to remain stable or show a minor decrease.

Figure 4. Development of grid demand and grid supply per capita in Israel during 2010-21 and projection for 2022.

In the past, the Electricity Authority estimated that the growth in electricity demand during the second and third decades of the 21st century is to be at 2.7% annually, which is slightly above the demographic growth rate. However, the growth of electricity demand in Israel was at 4.1% in 2019, but in 2020 experienced flat growth due to the Covid19 crisis and declined since. Though there is still a total electricity demand growth due to demographic expansion, the main element to support electricity demand growth in upcoming years is the wide-spread adoption of electric vehicles.

The transmission and distribution segments continued to be controlled by the IEC, but after the adoption of the Electricity Reform, the grid control department was split into a separate company in 2019 and received operation license in June 2020. Distribution segment has about 10% share licensed to the Kibbutzim and the rest controlled by IEC; more players are expected to enter this segment as virtual providers upon the implementation of the market reform. Notably, in 2021 it was announced that 18 players would enter the distribution segment under this framework, increased to 24 by the end of the year and to 33 players by mid 2022.

The off-grid electricity market in Israel is essentially small, estimated at only several megawatts deployed in desolate locations, including diesel generators and solar PV collectors. There are however four major facilities for self-consumption which are essentially off-grid - the Noble Energy Mediterranean 31.85 MVA offshore generation unit at the Tamar gas field, the Rotem Amfert 16.7 MWp generation unit, the Ben Gurion Airport 12.4 MWp facility and the Nesharim Energy 2014 facility rated 48.3 MWp.

The premium member data page access and extended commercial report can be purchased at LNRG Technology digital store.